Redefining App Development: MentalGrowth in 2025

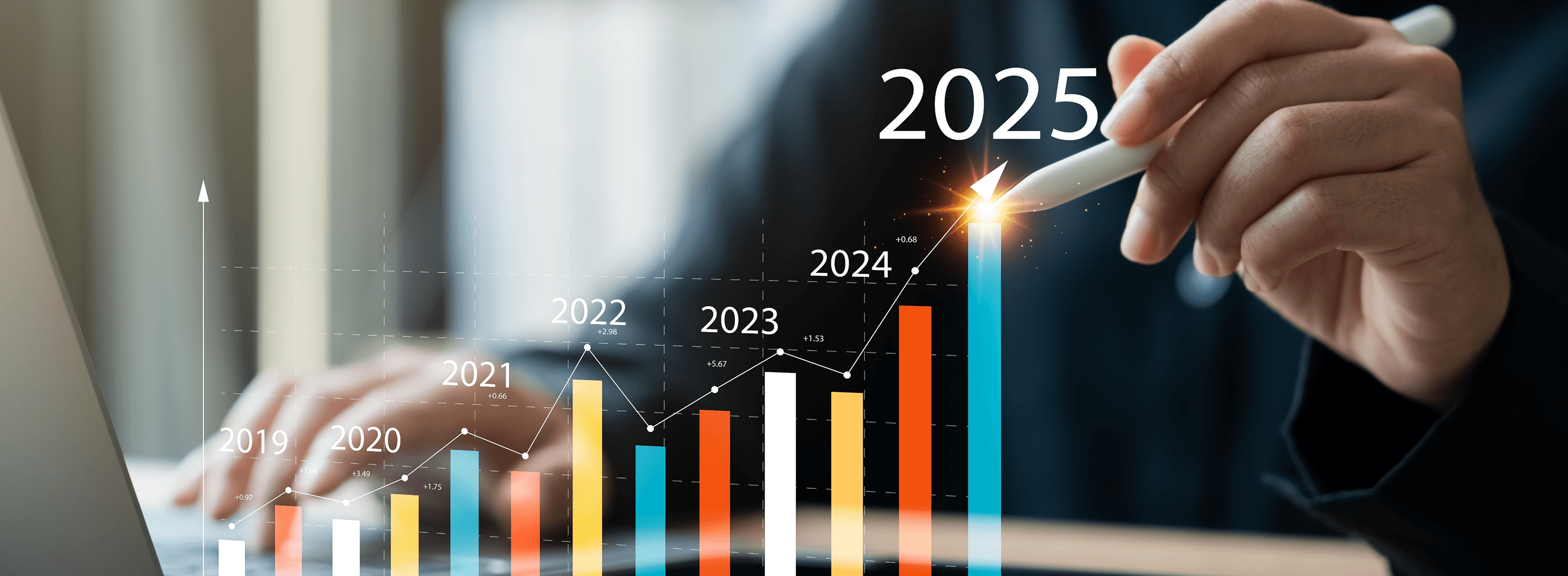

MentalGrowth is a lifestyle and wellness app development company whose products have reached over 2.5 million mobile installs and more than 14.5 million unique users on the web. In the past 12 months alone, the company recorded 13.4 million unique web users, 129,000 app users, and over 14.7 million sessions across platforms — with more than $2.3 million in app revenue to date.

CEO and Co-founder Egor Rubtsov shares hard-earned lessons from a journey that began with instinct and experimentation and matured into a sophisticated, data-driven operation.

Measuring what matters

When we launched Mental Growth seven years ago, we were a small team just trying to get (a meditation app) on a subscription model out the door. We didn’t have dashboards or funnels. Our metrics were basic: Are people opening the app? Are they listening to sessions? Are they subscribing?

In the early days, it took us 6–9 months to develop a new app. It was a productive cycle, made possible by a market that was relatively open and transparent. We acquired users and generated revenue with minimal targeting and topline data. But we quickly learned that our focus shouldn’t solely be on metrics like retention, engagement, and average user lifetime. These became the foundation of our evolution, but it was important to focus on monetization too.

Responding to an evolving infrastructure

Apple’s shift away from Identifier for Advertisers (IDFA) marked a turning point. Precision targeting vanished overnight. We had to develop new skill sets across the team. The goal became clear: deliver value faster, deeper, and more consistently. At this stage, the primary focus was on subscription cancellations via app uninstalls, and secondarily — on onboarding optimization, trial handling, and testing subscription models and pricing.

Another major wake-up call came when Apple started canceling subscriptions as soon as users deleted an app. This fundamentally changed the financial rules of the market. Previously, companies relied on a long revenue tail and could afford aggressive marketing spend. With this change, that “long tail” disappeared, which radically altered the spending logic: user acquisition became more expensive, and revenues declined.

Suddenly, we had to earn every single subscription. The margin for error vanished. If a user didn’t find value immediately, they left. Stricter data privacy laws in the EU and U.S. further complicated the landscape. Where we once saw detailed user profiles, we now saw black boxes. Marketing became hypothesis-driven. Instead of scaling broad campaigns, we began targeting with surgical precision. This had a major impact on budgets and market players. The ROI and overall profitability of the industry changed significantly.

Even trials, once a core driver of growth, began to lose power. The market was saturated. People hopped between apps, trying everything and committing to nothing. We realized that we didn’t need to do more; we needed to do better, especially in those first interactions.

By 2021, we started focusing on the initial moments of user engagement: onboarding, trial conversion, and the first session. How fast can we show value? What happens in the first 30 seconds? That clarity transformed our monetization strategy. Since endless renewals were no longer guaranteed, companies had to extract more value upfront from each user. As a result, all monetization efforts were concentrated there.

Reinventing the product strategy

In the early stages, we were operating blindly, as Facebook, Europe, and Apple were heavily anonymizing user data and we had to acquire users without really knowing who they were. We no longer knew what people were interested in, whether it was meditation, weight loss, face workouts, back pain relief, and so on. Previously, we spent 6–9 months on each app. But now we couldn’t afford to spend 6–9 months developing blindly and risk missing our target audience. This was when we chose to make a strategic move to develop the single large “super app” model which allowed us to:

Track market trends;

Understand what each user cares about;

Provide the broadest possible value proposition for an anonymized user.

Once we identified the user’s pain points within the super app and understood the demand, we could start building micro-apps based on specific micro-trends. Later, we transitioned to web funnels, built cross-platform capabilities, and learned how to operate in a privacy-first world.

We created Youth, a health and fitness app. Over time, we found that breaking it into smaller, focused micro-apps offered greater agility and better monetization. These micro-apps only took two months to develop, grounded in trend analysis which we had learned from the super app and refined through performance data.

Operationally, apps like Youth and Mimika complemented each other, offering different usage cycles and helping us smooth out seasonality. The infrastructure we built for one often applied to the other, allowing us to scale efficiently.

Another key move was shifting from mobile-only to web-first experiences. This wasn’t just a reaction to Apple’s App Tracking Transparency changes — it was a calculated pivot. The Web gave us more control over the user journey, stronger conversion paths, and better unit economics. It also gave us the ability to reach not only the iOS ecosystem but also Android users — they could access our product through the web. This significantly expanded our audience. In fact, web-based users now deliver nearly twice the average revenue compared to mobile.

From instinct to intelligence

By 2024, we’d evolved into a highly analytical organization. We track hundreds of metrics across all products. We model full profit and loss forecasts. We work with cohorts, payback periods, and LTV curves. We no longer think in terms of just installs or trials; we think in terms of value over time.

We’ve gone from launching and hoping to building with precision. We test hypotheses, analyze micro-trends, and even learn from offboarding feedback. The market never stops changing, and we’ve accepted that our approach can’t either. As a result of this evolution, our organizational structure also evolved significantly. We introduced dedicated product managers focused on subscriptions and onboarding; we introduced a separate team formed to track and analyze trends, and we established an independent growth team.

Six lessons from the MentalGrowth journey

1. Make the first session count: that’s where trust is won or lost.

2. Don’t chase trends—analyze them: use data to validate ideas, not to blindly follow hype.

3. The Web isn’t just a backup—it’s a revenue multiplier. Take ownership of the user journey.

4. Think like an economist, act like a user: match business logic with genuine user value. Success in this business relies heavily on investments in analytics and the team working with numbers, because long-term success depends on having clear and transparent revenue planning at least a year ahead.

5. Evolve your stack, not just your app: teams, tools, and workflows must grow with your product.

6. Marketing before the user even enters the app plays a crucial role — including user warming-up and pre-engagement. It requires a massive amount of creatives that are relevant and appealing to the user. This is a key success factor and demands a dedicated team.

For us, innovation isn’t just about technology. It’s about staying relevant. That means never settling, always adapting, and delivering measurable value, right from the very first tap.